“Incoterms”: the query gets more than 300,000 search hits on Google a month – clearly it’s a subject that raises plenty of questions for both buyers and sellers when it comes to writing their business contracts. You’ll find many theoretical explications on Incoterms, based on the interpretation of the definitions and rules published by the International Chamber of Commerce. However, our advice is based on the operational point of view of a freight agent, particularly when it comes to experience with the Ex Works Incoterm.

Incoterms and push/pull strategy.

The minimum you need to know as an exporter or importer:

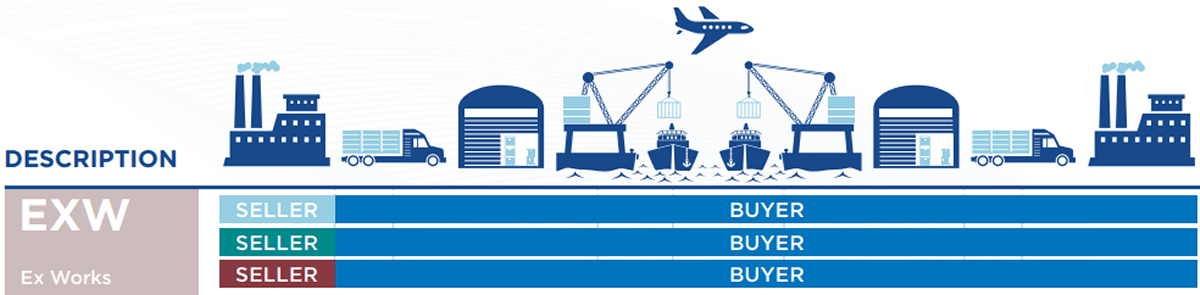

- The Incoterm serves to establish where and how the shipping risks and costs are transferred from the seller to the buyer.

- So, an Incoterm should, by necessity, include a placeand some complementary optional information (e.g. “DAP Container Free Station Johannesburg excluding unloading charges”).

- The person who is covering the costs, the one who covers the main transport according to the Incoterm, is the person who should decide upon the shipping (method, time-frame, service provider). The important question is then who is covering the costs:the buyer or the seller?

Selecting an Incoterm is making a strategic decision in terms of logistics: should you be working in push or pull strategy?

- Using a push strategy (push) means the seller pays and decides on the method of shipping – the seller’s aim is to sell as quickly as possible.

- With the pull strategy (pull), the buyer decides on the shipping and pays at the destination, with the aim of controlling their supply chain according to their needs (tight flows, just in time etc.)

‘Pull‘Incoterms represent almost 70% of the market. We recommend FCA and FOB but not EXW. This is why.

Why should you avoid export sales using the Ex Works (EXW) Incoterm?

The EXW incoterm means Ex Works, which means “upon exiting the factory”. This incoterm means that the seller makes their merchandise available to the buyer outside of their factory. The buyer takes on all the shipping and customs costs and any risks linked to transporting the goods to the destination.

The EXW Incoterm may seem like a great option for exporters: you’ll benefit from reduced costs and liability. However, it’s a dangerous option.

An example of a French exporter.

A French exporter using an EXW incoterm will invoice without taxes and wants to appear as the exporter on the administrative documents (SAD – Single Administrative Document).

So he will need to recuperate the SAD “upon exit from the country” or keep alternative proof that the merchandise has indeed left the European Union Customs Territory. The problem with EXW is is that he won’t be in control of the export customs formalities, nor the choice of customs representative. Sometimes he even cannot appear over the document for opacity reasons.

The risks are as follows:

- Without a SAD or alternative proof of leaving the EU customs territory, the exporter’s billing without taxes will be denied during a tax inspection.

- Without being in control of the information written on the SAD (nomenclatures, value, origin), these could be wrong and leave the exporter open to customs litigation.

- The exporter is obliged to make his merchandise available packaged suitably for shipping (parcel or palet). Often he must also load the lorry that’s been sent by the buyer himself, so he’ll need personnel to do this, which could put his employees at risk.