Quick Tips for Logistics Professionals

Every year, the Combined Nomenclature defining customs codes and tariffs for the European Union changes, particularly in January and July. This year, EU/US trade measures add their own set of changes.

Every year, the Combined Nomenclature defining customs codes and tariffs for the European Union changes, particularly in January and July. This year, EU/US trade measures add their own set of changes.

- The main changes to the European customs tariff on January 1, 2025 concern sharks, tomatoes, tropical fruits, ornamental stones, rare gases, oils, biofuels and bituminous materials, hydrocarbons and their derivatives, fertilizers, wood waste and laminate flooring, aluminum, 3D printers, lithium batteries and static converters (chapters 3, 8, 10, 25, 27, 28, 29, 31, 44, 76, 84 and 85).

- European countermeasures to the tariffs imposed by the US administration in March/April 2025 are expected, but have not yet been confirmed.

To check the customs tariffs applied to your products and the changes that occurred in January 2025:

- Download the European customs tariff 2025 (PDF, 23/9/2024 effective as of 1/1/2025, source EUR-LEX) and identify changes (★ or ■)

- Use the customs code correlation table 2024-2025 published by the EU (XLS, 10/1/2025, source CIRCABC)

- Check the European TARIC/10 nomenclature (XLS, 14/1/2025 FR / EN, source CIRCABC)

- Check daily updates on the French service RITA News bubble – Nomenclature changes.

To clear all goods crossing international borders, customs, customs declarants and freight forwarders use customs codes, called HS codes ( Harmonized System) codes, or commodity codes codes.

> See our article: HS codes: what you need to know when trading with the EU.

In the European Union (EU), these codes are defined in the Combined Nomenclature (CN) , which organizes goods without the Common Customs Tariff that applies when entering the European Union. Every year, the 8-digit Combined Nomenclature evolves to keep pace with the reality of international trade. A major update is made in January, followed by others, notably in June/July. In 2025, we also have to reckon with the turbulence of tariffs with the United States.

Changes to European Customs tariff on January 1, 2025

The September 23, 2024 edition of the European customs nomenclature, which came into force on January 1, 2025, involves 21 new and 528 closed 10-digit customs codes in several chapters of the Combined Nomenclature. Here is an overview of the main chapters and products affected:

Chapter 3: Fish and crustaceans, molluscs and other aquatic invertebrates

★ Introduction of specific subheadings for certain sharks, notably the shortfin mako (Isurus oxyrinchus) and the blue shark (Prionace glauca).

Chapter 7: Edible vegetables, plants, roots and tubers

★ Creation of subheadings for fresh tomatoes according to diameter and type of presentation (bunches, bulk).

Chapter 8: Edible fruit and nuts; peel of citrus fruit or melons

★ Introduction of new subheadings for certain varieties of tropical fruit.

Chapter 10: Cereals

★ Creation of specific codes for organically grown cereals.

Chapter 25: Salt; sulfur; earths and stone; plaster, lime and cement

★ Detailed revision of subheadings for ornamental stones according to origin.

Chapter 27: Mineral fuels, mineral oils and products of their distillation

★ Additions and clarifications to the classification of oils, biofuels and bituminous materials.

Chapter 28: Inorganic chemicals

★ Introduction of subheadings for certain rare gases (krypton, neon, xenon).

Chapter 29: Organic chemicals

★ Reorganization of certain subheadings for hydrocarbons and halogenated, sulfonated, nitrated or nitrosated derivatives.

Chapter 31: Fertilizers

★ Creation of subheadings for urea in liquid form and adjustments to the classification of chemical fertilizers.

Chapter 44: Wood, charcoal and articles of wood

★ Introduction of new subheadings for wood waste and laminate flooring.

Chapter 76: Aluminium and aluminium structures

★ Refining the distinctions between aluminium alloys and unalloyed aluminium.

Chapter 84: Nuclear reactors, boilers, machinery, apparatus and mechanical devices

★ Updated classification for 3D printers using sand, cement or other mineral products.

Chapter 85: Electrical machinery and equipment

★ Creation of new subheadings for high-capacity lithium batteries and revision of static converters.

These changes are designed to better reflect technological developments, strengthen the control of sensitive goods, and improve the statistical accuracy of trade flows.

US tariffs and European response (March/April 2025)

The United States had imposed so-called “Section 232” tariffs on European steel and aluminum back in 2018, prompting an initial two-phase response from the EU. However, in 2021, both parties agreed to suspend these duties in order to negotiate a longer-term solution. With this suspension due to expire on March 31, 2025, European countermeasures would be automatically reactivated on April 1, 2025.

Since March 12, 2025, the USA has reintroduced a 25% surtax on steel, aluminum and related products from the EU (kitchen utensils, gym equipment, machinery and furniture containing steel or aluminum), impacting €26 billion of EU exports, or around 5% of total EU goods exports to the USA.

In response, the European Commission considered reviving its customs countermeasures, and launched a consultation before publishing a list of American products which could be affected by import countermeasures. Implementation has not been confirmed, but is imminent (mid-April 2025).

The French authorities have provided companies with the following information pages:

- USA page of the French Ministry of Economy and Finance on U.S. tariffs and the European response, updated regularly.

- French Customs USA page (DGDDI), constantly updated (FAQ, details given by the Customs Advisor in Washington…)

- You can also follow the USA dossier on international-pratique.

We’ll keep you informed as soon as we’ve stabilized the situation.

How do you check your customs codes in 2025?

RITA – French customs nomenclature

TARIC – EU Customs Tariff

EUR-Lex – Combined Nomenclature

HS Tracker (WTO/WCO)

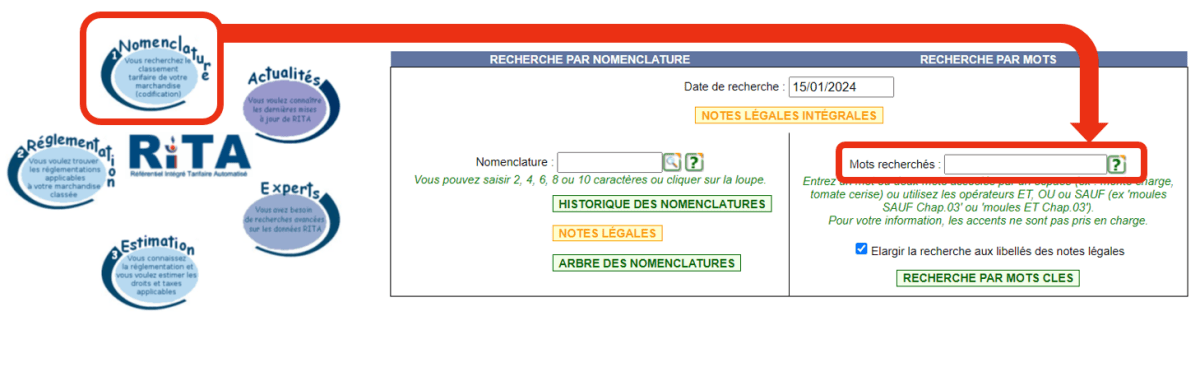

RITA: check the customs code of your goods and follow the latest news

The RITA (Référentiel Intégré du Tarif Automatisé) is the reference catalog of the EU and French customs tariffs and is constantly updated by the French Customs. It brings together regulations concerning the tariff classification of goods, applicable duties and taxes, required accompanying documents, etc.

The RITA encyclopedia offers you a dematerialized version of the customs tariff, with search ergonomics infinitely superior to those of the official text available on EUR-lex!- Use RITA to determine your customs codes by going to douane.gouv.fr, RITA Encyclopedia.

- Check for changes during the year on RITA > bulle Actualités – Modifications de nomenclatures. Please note that these news are only available temporarily.

- Use RITA to determine your customs codes by going to douane.gouv.fr, RITA Encyclopedia.

Eur-Lex: download the European customs tariff 2025 and check for changes

Download the European Customs Tariff 2025 in PDF in English, French or the language language of your choice on the EUR-Lex website.

To identify changes, search (ctrl + f) for ★ or ■ in the PDF version:★ denotes new customs code numbers;

■ denotes code numbers that were used the previous year, but with a different content.TARIC: check correlations and consult the EU’s Integrated Tariff online

The European Commission maintains the TARIC (Integrated Tariff of the European Union) database.

- To help you check whether the customs codes used by your company will change between 2023 and 2024, use the TARIC 2024/2025 correlation table (updated 10/1/2025, excel, source CIRCABC).

- Consult the TARIC Europa database online on the EC Europa website, updated daily, and watch for TARIC news on CIRCABC.

For the record:- The last 2 digits (10 and 80) indicated in the columns following the TARIC code are “indices” and are not part of the TARIC code itself.

- The codes followed by an index 10 are “intermediate” lines of the nomenclature, i.e. “subheadings” of descriptions. These positions followed by 10 are therefore not “reportable” TARIC codes.

- The codes followed by the index 80 are the TARIC codes “declarable” for customs clearance.

- See sheet 1 “TO READ” of the excel table for further explanation.

Use the HS code nomenclature of the World Customs Organization (WCO)

The HS codes were last revised worldwide in 2022. The revision cycle is normally every 5 years, but for this edition the cycle has been extended by one year, bringing the next edition to 2028. The next edition of 6-digit Customs Code (HS6) will come into force on January 1, 2028.

Use HS TRACKER from the World Trade Organization and the World Customs Organization to track the evolution of your HS codes from 1992 to today.

Expected changes to the WCO in 2028

The WCO has already reported on trends and recommendations for the next edition of SH2028:

- PCB-containing waste oils falling under subheading 2710.91 will have to be specified in order to collect more precise data on transboundary waste movements, so as to monitor compliance with commitments made under the Basel Convention.

- HS compliance with the Chemical Weapons Convention (CWC): countries are invited to take into account the new chemicals in OPCW Schedules 1 and 2.

- Two compounds have been added to Annex III of the Rotterdam Convention, which lists pesticides and industrial chemicals banned or severely restricted for health or environmental reasons. An update will therefore be required for 2903.

More information on customs codes and tariffs

- Customs codes: what you need to know when trading with the EU

- How to check your customs codes and tariffs in 2025?

- Check the changes in European Union tariffs in 2020, 2021, 2022, 2023, 2024.